Overview:

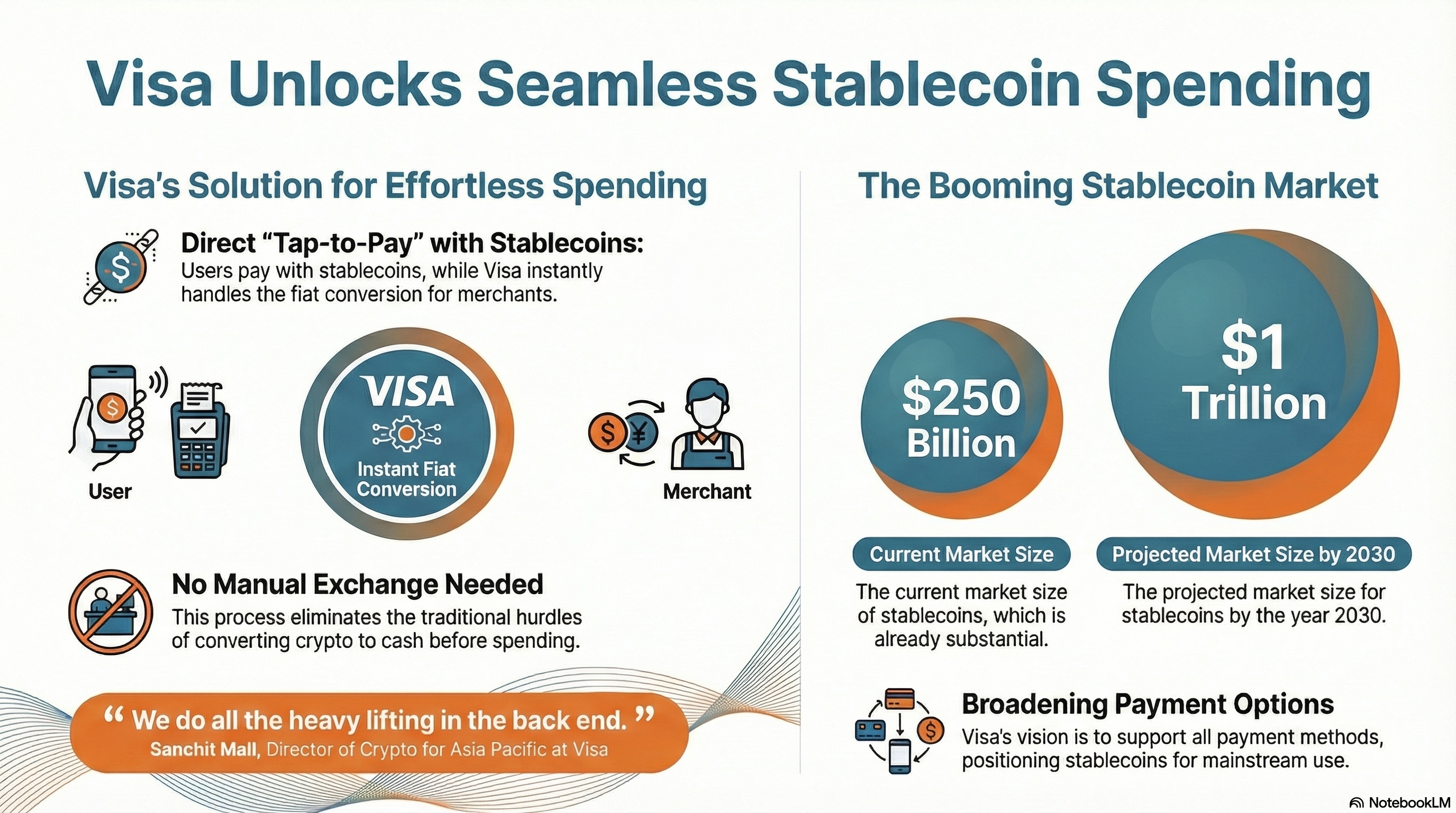

- Visa is driving seamless stable coin spending across APAC by integrating conversion into its payment network.

- The company has adopted new blockchain technology and supports four stable coins alongside existing infrastructure.

- Visa aims to eliminate traditional exchange hurdles, enabling direct stable coin-to-fiat transactions at point of sale.

- Stable coin adoption is accelerating, with market size projected to grow from $250 billion to $1 trillion by 2030.

- Visa’s vision is to embrace all payment methods globally, positioning stable coins as a mainstream consumer option.

Visa is making it easier for consumers in Asia Pacific to spend stable coins directly at merchants, eliminating the need for cumbersome exchanges and conversions.

Visa Enables Stable Coin Spending Without Hassle

The payments giant has integrated stable coin functionality into its existing network, allowing users to tap their cards and pay in stable coins while Visa handles conversion to fiat in the background. “We do all the heavy lifting in the back end. All you need to do is take out your phone, tap the card, and there you go,” Sanchit Mall, Director of Crypto and Digital Currencies for Asia Pacific at Visa.

Visa currently supports four stable coins and has embraced four new blockchains to power this capability. This move comes as global stable coin adoption accelerates, driven by demand for faster, borderless payments.

Stable Coin Market Poised for Explosive Growth

The stable coin market has already reached $250 billion and is projected to hit $1 trillion by 2030, according to Mall. “Stable coin is growing, and given the demand at the moment, we see it will continue to grow,” he added.

Visa’s strategy aligns with its broader vision to support all payment methods globally, positioning stable coins as a mainstream option for everyday transactions.

More stories: Visa unlocks access to credit for 65% of Asians who don’t have it

About the speaker:

Sanchit Mall

Director, Crypto and Digital Currencies, Asia Pacific

VISA

Sanchit Mall, Director of Crypto & Digital Currencies at Visa Asia Pacific, is a seasoned leader in digital assets and blockchain innovation. Based in Singapore, he brings over 15 years of experience spanning fintech, capital markets, and Web3 technologies. Before joining Visa, Mall spearheaded crypto and Web3 initiatives at Worldpay and drove business development at Matrixport, making digital currencies mainstream. His career includes strategic roles at Mastercard and Keppel Corporation, where he managed multi-million-dollar projects and partnerships. An MBA graduate from Cornell University, Mall combines technical expertise with business acumen to advance the future of digital finance.

FAQs:

What is Visa’s approach to stable coin payments?

Visa enables consumers to spend stable coins directly at merchants by converting them into fiat seamlessly in the background.

Do I need to convert stable coins to fiat before making a purchase?

No, Visa handles the conversion automatically at the point of sale, so you can pay with stable coins without extra steps.

Which stable coins does Visa currently support?

Visa supports four major stable coins and continues to expand its capabilities as adoption grows.

What technology powers Visa’s stable coin transactions?

Visa uses its existing payment infrastructure combined with new blockchain integrations to process stable coin payments securely.

Is this service available across Asia Pacific?

Yes, Visa has rolled out stable coin payment capabilities for the APAC region, including Singapore and ASEAN markets.

How does Visa ensure regulatory compliance?

All stable coin transactions are processed within regulatory frameworks, ensuring security and compliance at every step.

What is the projected growth of the stable coin market?

The stable coin market is expected to grow from $250 billion today to nearly $1 trillion by 2030.

Why is Visa investing in stable coin technology?

Visa aims to embrace all payment methods and meet consumer demand for faster, borderless, and digital-first transactions.

Do merchants need special systems to accept stable coins?

No, merchants can continue using existing Visa-enabled systems while Visa manages the conversion process in the backend.

Will Visa support more stable coins in the future?

Yes, Visa plans to expand its stable coin support as adoption and demand continue to rise globally.

5W1H summary:

| Category | Summary |

|---|---|

| What |

1. Visa enables stable coin spending 2. Supports four stable coins currently 3. Converts stable coins to fiat seamlessly |

| How |

1. Uses existing Visa infrastructure 2. Adds blockchain integrations for processing 3. Handles conversion in backend automatically |

| Why |

1. Rising demand for stable coin payments 2. Market projected to hit $1 trillion 3. Consumers want borderless payment options |

| Who |

1. Visa as global payment network 2. Sanchit Mall leads APAC crypto strategy 3. Consumers and merchants in ASEAN region |

| Where |

1. Asia Pacific including Singapore 2. Expanding across ASEAN markets 3. Global rollout planned in future |

| When |

1. Current adoption already in progress 2. Market growth forecast by 2030 3. Technology implemented alongside existing systems |

Transcript of the interview:

I take care of Visa’s stable coin business for the APAC region, and we are seeing a lot of tailwinds coming in. One of my core priority at the moment is for people to be able to spend their stable coins seamlessly.

As you would have seen, there is a lot of demand for stable coin, and we are seeing a lot of stable coin adoption. Now, imagine you are a stable coin enthusiast and 100% of your saving is in stable coins.

Now at the end of the year, you want to go on a holiday with your family to Bali. You are sitting there at the beach, want to enjoy a nice Thai coconut water, and all you have is stable coin.

What do you do in a normal world? You will have to go to an exchange, convert it into fiat, and you have to go through a lot of hoops.

We at Visa make it seamless for you to be able to spend that stable coin and get that your daughter or your son to be able to drink that Thai coconut seamlessly.

We do all the heavy lifting in the back end. All you need to do is take out your phone, tap the card, and there you go.

We in the back end, we make sure that all that flows seamlessly, able to convert the stable coin into fiat all through within the regulatory scope and at the best effect rate that is possible.

And is this on your existing technology or have you had to implement something additionally?

We have embraced this new technology. In addition to the existing technology, we are now able to accept four stable coins already.

We are embracing four new blockchains as well. It is on the existing technology.

And where do you see this going, like what is the grand vision?

I think we, as Visa as a network, we want to embrace all the payment methods that are out there. Stable coin at the moment, we want to give that option to all the consumers to be able to accept and spend.

Stable coin is growing, and given the demand at the moment, we see it will continue to grow. We are seeing tremendous growth.

Now, the stable coin has reached almost $250 billion, and we are predicting it to go to almost $1 trillion by 2030.

That is four times, and it will continue to get adopted.