Overview:

- Standard Chartered targets zero false positives in transactions

- AI-driven cybersecurity aims to reduce client friction

- Three-pillar strategy focuses on people, tech, and business alignment

- KPIs include friction reduction and peer benchmarking

- Goal is seamless, secure cross-border payments for clients

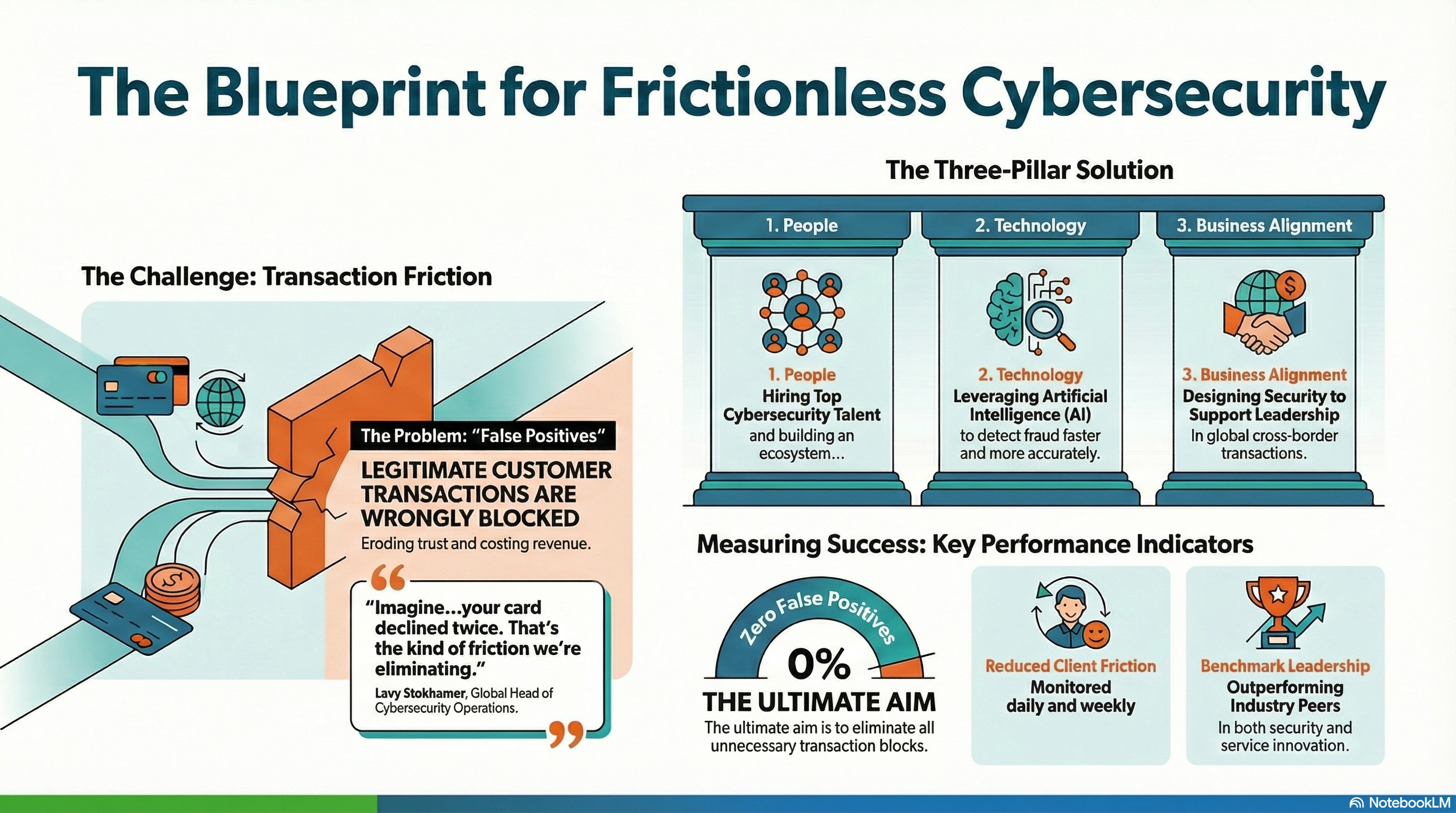

Standard Chartered is taking aim at one of the most frustrating pain points in modern banking: legitimate transactions being wrongly blocked. The bank’s strategy, branded as frictionless banking cybersecurity, focuses on eliminating false positives without compromising security—especially in high-stakes scenarios like cross-border payments.

“Imagine hosting a business dinner in Dubai, signing major deals, and then having your card declined twice. That’s the kind of friction we’re eliminating,” said Lavy Stokhamer, Global Head of Cybersecurity Operations (CyOPS) at Standard Chartered.

Three pillars of the strategy

Stokhamer outlined three core investments driving this transformation:

- People: Hiring top cybersecurity talent and building an ecosystem that fosters growth.

- Technology: Leveraging AI to detect fraud faster and more accurately. “AI is very helpful for attackers but also for defenders, so we are making sure that we’re going to be the first in the industry to leverage AI capabilities in order to protect the bank,” Stokhamer noted.

- Business alignment: Designing security measures that support the bank’s ambition to lead in cross-border transactions.

KPIs that matter

The program’s success will be measured by:

- Zero false positives: Aiming to eliminate unnecessary transaction blocks.

- Reduced client friction: Monitored daily and weekly through client and relationship manager feedback.

- Benchmark leadership: Comparing performance against peers to stay ahead in security and innovation.

Why frictionless banking cybersecurity matters

False declines cost banks trust and revenue. Standard Chartered’s approach ensures that security controls adapt to real-world client behavior, enabling smooth, secure transactions across markets. By combining AI-driven precision with human expertise, the bank aims to deliver a seamless experience without sacrificing protection.

The ultimate goal: a world where clients transact confidently, knowing their bank can stop fraud without stopping business.

More stories: Kaspersky expands cybersecurity education to tackle rising digital risks

About the speaker:

Lavy Stokhamer

Global Head of Cybersecurity Operations (CyOPS)

Standard Chartered

Lavy Stokhamer, Global Head of Cybersecurity Operations (CyOPS) at Standard Chartered, leads the bank’s global cyber defense strategy and operations. With extensive experience spanning both public and private sectors, he previously served as head of the Israeli national CERT, where he directed national cyber operations and incident response.

Stokhamer has forged over 80 international cooperation agreements and played a pivotal role in global cybercrime initiatives through the World Economic Forum, working with INTERPOL, Europol, and leading alliances. He also pioneered cybersecurity innovation in Israel’s financial sector and holds credentials from Reichman University and Harvard’s Cyber Security Risk Management program.

Frequently Asked Questions:

1. What is the main goal of Standard Chartered’s cybersecurity strategy?

The goal is to eliminate client friction and reduce false positives to zero while maintaining strong security.

2. How is Standard Chartered using AI in cybersecurity?

AI is deployed to detect fraud faster and more accurately, helping distinguish real threats from legitimate transactions.

3. Why is reducing false positives so important?

False positives cause legitimate transactions to be blocked, leading to client frustration and potential business loss.

4. What are the three pillars of this strategy?

People, technology, and business alignment form the foundation of the bank’s cybersecurity approach.

5. How does the bank measure success in this initiative?

Through KPIs such as zero false positives, reduced client friction, and benchmarking against industry peers.

5W1H summary:

| Category | Details |

|---|---|

| What | 1. Eliminating payment friction for clients 2. Reducing false positives to zero 3. Enhancing cybersecurity with AI |

| How | 1. Invest in top cybersecurity talent 2. Deploy AI for fraud detection 3. Align security with business goals |

| Why | 1. Prevent client frustration during transactions 2. Build trust in cross-border payments 3. Stay ahead of cyber threats |

| Who | 1. Standard Chartered Bank 2. Lavy Stokhamer, Global Head of CyOPS 3. Affluent clients and business partners |

| Where | 1. Global operations 2. Example scenario in Dubai 3. Focus on cross-border transactions |

| When | 1. Current cybersecurity strategy rollout 2. Continuous daily and weekly monitoring 3. Future goal: zero false positives |

Transcript of the interview:

Imagine that you are an affluent client. You are a wealthy business guy and you take your business partner to a dinner in one of these great restaurants in Dubai.

A Japanese one. I don’t know what’s your favorite one, but I love Japanese restaurants.

You have a nice dinner, a great dinner. You signed a lot of agreements around your business and growth and you’re getting the bill and you pull out your credit card and want to pay for this dinner.

You invited this dinner and the waiter comes and says that the transaction got blocked. You try your second credit card; again transaction blocked.

Meanwhile, you’re getting a message on the phone: Abnormal transaction got blocked. Imagine the frustration.

Try to call your bank but no one answers. Those are exactly the friction points that we are eliminating for our client experience.

No more friction around service security. No more friction around fraud attempts and those kind of scenarios while maintaining the protection of the clients.

That’s what we’re doing in Standard Chartered and cyber security.

And how are you doing this differently at Standard Chartered?

We invest in three main areas:

- One and the most important is people. We invest in people to bring the best people in the world to build the whole ecosystem around them to make them grow and be worthy to invest around the cyber security era.

- Technology. You probably have seen all the latest news around AI; AI is very helpful for attackers but also for defenders, so we are making sure that we’re going to be the first in the industry to leverage those kind of AI capabilities in order to protect the bank.

- And third, to understand the business context, to understand the strategy. If we are aiming to be the number one cross-border transaction bank, this is where our cyber security strategy is going to drive us to as well.

And what are the outcomes that you’re hoping for? What are your KPIs?

A few KPIs that we have:

And three, we also try to understand where our peers are and what’s the benchmark where we are within this benchmark and drive ourselves into those areas where we’re going to be the best in what we’re doing, best to be secure and to leverage innovation.

One is to make sure that we have zero false positives, so gradually reducing the false positive for those kind of attempts.

Second, to reduce friction from the client. We measure it on a daily basis, on a weekly basis; we engage with our relationship managers; we’re engaging with our clients in order to better understand the friction and then to measure ourselves if we’re reducing the friction in those areas.