Overview:

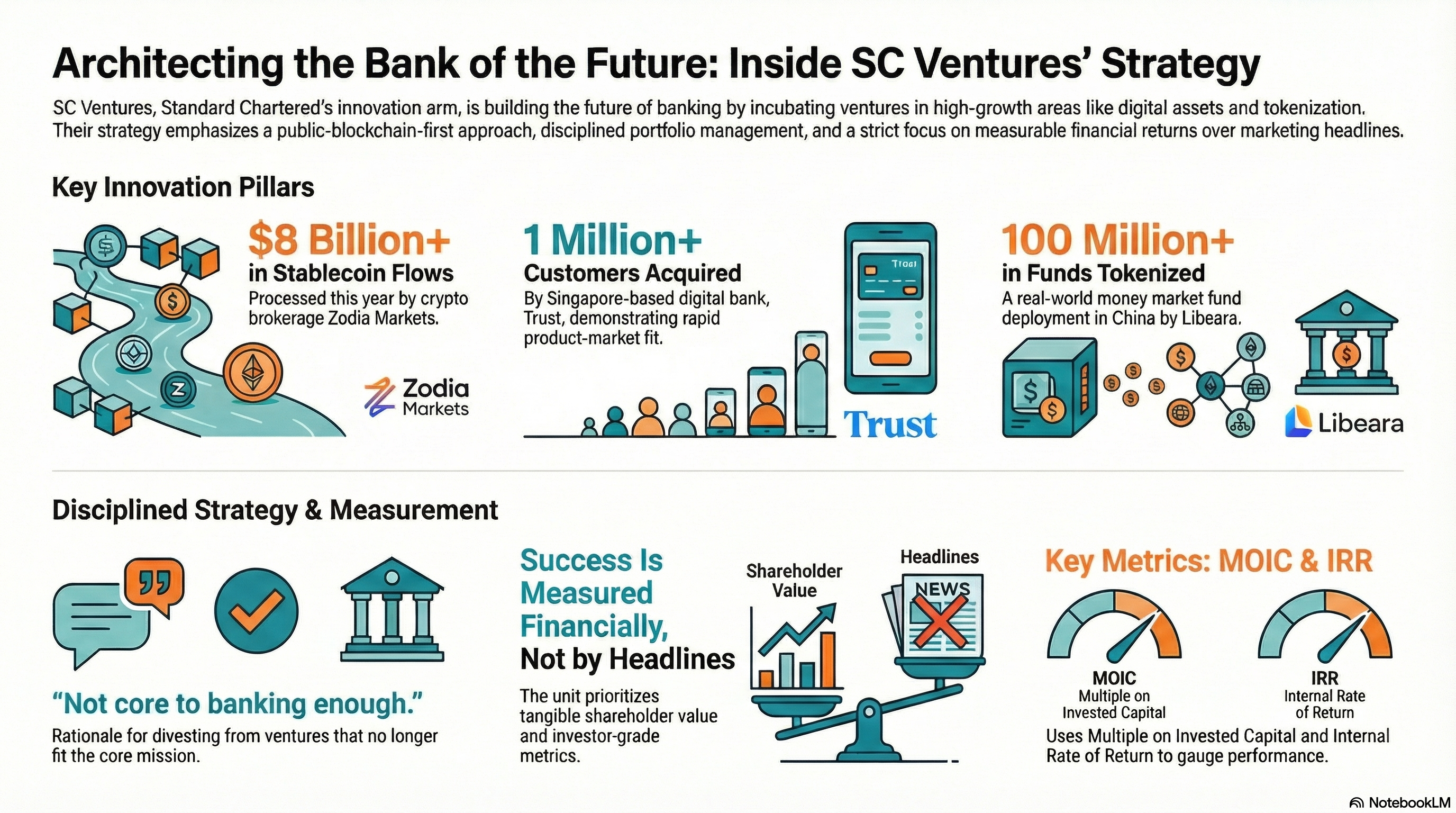

- SC Ventures has incubated more than 30 ventures

- Focus areas include digital assets and tokenization

- Zodia Markets processed $8 billion in stablecoin flows

- Trust digital bank surpassed 1 million customers

- Future bets include AI and quantum computing

SC Ventures has incubated more than 30 ventures and is doubling down on digital assets, tokenization, and pragmatic bets in AI and quantum computing—anchored by measurable financial outcomes and disciplined portfolio pruning under its SC Ventures digital assets strategy.

Digital assets and public blockchains as the edge

SC Ventures says it staked an early position on public blockchains, arguing openness is critical for market-scale adoption and an edge over bank-led, closed systems. A flagship example is Zodia Markets, which has processed more than $8 billion in stablecoin flows this year. “Zodia Markets is our crypto brokerage company that has done more than $8 billion of flows with stablecoins this year,” Harald Eltvedt, Operating Member, SC Ventures, Standard Chartered, told BackgroundBriefing.news.

The portfolio’s scale also shows in consumer finance. Trust, a Singapore-based digital bank incubated by SC Ventures, has surpassed 1 million customers, which the unit frames as evidence of product–market fit achieved at speed. That public-chain-first stance is central to the SC Ventures digital assets strategy, positioning ventures to compete against larger incumbents that favor private rails.

Tokenization milestones and disciplined exits

Tokenization is another pillar. Libeara, an SC Ventures-backed firm, recently tokenized over 100 million worth of money market funds in China with a partner—an outcome the unit cites as real-world progress beyond proofs of concept. Tokenization efforts also extend the SC Ventures digital assets strategy across bonds and funds, with an emphasis on deployments that can scale.

On portfolio discipline, Eltvedt said SC Ventures routinely pivots, deconsolidates, or exits when a business no longer fits the mandate to build “the bank of the future.” One example is CardsPal, which SC Ventures sold after determining the business was not core to banking. “Not core to banking enough,” says Eltvedt.

How success is measured

Eltvedt underscores that SC Ventures measures itself first by financial results, not marketing headlines. The unit applies investor metrics—Multiple on Invested Capital (MOIC) and Internal Rate of Return (IRR)—and targets tangible contributions to group shareholder value, reflecting a build-to-scale, not build-to-announce, mindset. “We measure success first and foremost financially,” Eltvedt noted.

Looking ahead, SC Ventures says it will continue building in AI and quantum computing, with an operational focus rather than splashy unveilings. The bar remains clear: ventures that are core to banking, demonstrably useful to customers, and accretive to returns—a test the SC Ventures digital assets strategy will continue to face.

More stories: Computer Weekly: Tech Giant Launches First AI Research Facility in Southeast Asia

About the speaker:

Harald Eltvedt

Operating Member

SC Ventures, Standard Chartered

Harald Eltvedt, Operating Member at SC Ventures by Standard Chartered, is a venture builder, investor, and entrepreneur with nearly two decades of international experience across Europe, Asia, and the United States. Based in Singapore, he has established himself as a leader in corporate innovation, specializing in highly regulated industries such as banking and healthcare. At SC Ventures, he works with founders, technologists, and regulators to create ventures that push the boundaries of digital assets, ESG, embedded finance, and decentralized platforms. His work emphasizes compliance, scalability, and societal impact in every project.

Beyond SC Ventures, Harald has held senior leadership roles at Havas and Pentalog, and co-founded RevSquare, a digital transformation agency later acquired by Globant. He is also the founder of Tetris Ventures and a board member of Libeara and Qatalyst. A competitive swimmer at heart, Harald co-founded Open Swim Stars and “La France à la Nage,” blending his passion for sports with community-building. Holding an Executive MBA from INSEAD, he continues to drive ventures that merge commercial success with social good.

Frequently Asked Questions:

1. What is SC Ventures’ main focus?

SC Ventures focuses on incubating ventures in digital assets, tokenization, AI, and quantum computing, aiming to build the bank of the future.

2. Which is SC Ventures’ most successful venture?

Zodia Markets stands out, processing over $8 billion in stablecoin flows this year, alongside Trust, a digital bank with over 1 million customers.

3. How does SC Ventures measure success?

They prioritize financial metrics like MOIC and IRR, ensuring ventures contribute to shareholder value rather than just strategic positioning.

4. Has SC Ventures exited any investments?

Yes, they sold CardsPal because it was not core to banking, showing their discipline in portfolio management.

5. What makes SC Ventures different from other incubators?

A diverse team of passionate bankers, technologists, and entrepreneurs who aim to solve real pain points through impactful ventures.

5W1H summary:

| Category | Key Points |

|---|---|

| What | 1. SC Ventures incubated over 30 ventures 2. Focus on digital assets and tokenization 3. Building in AI and quantum computing |

| How | 1. Early bet on public blockchain 2. Incubated ventures like Trust and Zodia Markets 3. Measures success via MOIC and IRR |

| Why | 1. To build the bank of the future 2. Drive shareholder value for Standard Chartered 3. Leverage innovation for competitive edge |

| Who | 1. SC Ventures team 2. Harald Eltvedt, Operating Member 3. Partners in tokenization projects |

| Where | 1. Singapore for Trust digital bank 2. China for tokenized money market funds 3. Global reach for digital assets |

| When | 1. Trust reached 1M users recently 2. Zodia Markets processed $8B this year 3. Tokenization milestone announced recently |

Transcript of the Conversation

What’s the latest and greatest at SC Ventures?

Latest news at SC Ventures, we’ve incubated over 30 ventures. Just to give you an idea of what that represents, in the space of digital economy for example, we incubated the fastest growing digital bank in the world called Trust here in Singapore. That’s more than 1 million customers. If you do the math, that puts us right on the map with the big ones. But we’ve also taken a big step in digital assets. We all know at SC ventures that digital assets are here to stay and we’ve incubated successful ventures such as Zodia Custody, Zodia Markets. So these are some of our big achievements. We’ve also decided to invest and build ventures in AI and quantum computing but in a very meaningful way. Not making big announcements but building things that are going to have an impact.

Congratulations on these 30 ventures. What would you say is your most successful investment so far?

We have a lot of successful ventures. I can start with one which is very close to what I’m doing in the theme of digital assets. I think compared to other banks we’ve made an early bet in digital assets. And we know for digital assets to thrive they need to be open. They need to be public, available. And that’s where we started having an edge versus the giants of JPM and Goldman Sachs. So from the get-go, we started with open public blockchain. So we’ve seen recently for example Zodia Markets. Zodia Markets is our crypto brokerage company that has done more than $8 billion of flows with stablecoins this year. That’s quite unique. So that’s one of our very successful ventures out there. We just successfully closed an investment round with them. So Zodia Markets is one of our very successful companies in the portfolio. Another one in this part of the world is a company called Libeara. Libeara does tokenization of bonds and funds. We recently announced the tokenization of over 100 million worth of money market funds in China with a partner and that positions us as one of the most innovative tokenization companies in this part of the world.

Okay. On the other end of the scale, what’s your worst investment?

I don’t like to talk about worst investments because we are in the business of building, testing, learning, and a lot of our companies are still very early stage. So whenever we feel we’re not doing the right thing, we’re not building the right company, we’ll just pivot it or we’ll discontinue it. But if they’re still active in our portfolio, it’s because we believe in them and because we believe that the future value is about to unlock is the reason why it’s still within our portfolio.

By any measure, startups have a patchy track record, right? Not every startup is going to become a unicorn. But are there some companies that you wish you hadn’t invested in?

Not every company can be a unicorn. That’s for sure. But I think as the investor, you make that call. And like I said, if they’re still in our portfolio, it’s because we believe in them. If they’re no longer in our portfolio, it’s because we’ve decided to move on and done something with it. I’ll give you maybe one specific example because I don’t want to elude the question, but one specific example, if we feel we’re no longer the rightful owner of that company, we’ll deconsolidate the company or we’ll sell the company. And we’ve done so for example with CardsPal. We decided to sell CardsPal because while we thought it was a very interesting proposition, we were not the rightful owner of that company.

What made you the wrongful owner of that?

Not core to banking enough. And our focus is providing the bank of the future, the bank of tomorrow and so that’s the ventures that we’re building. If it’s outside of that, then we’re comfortable having it as a minority investment or deconsolidating completely your position so that we no longer own that company.

What does SC Ventures have that other incubators don’t?

We have a team of very passionate people. I think that makes a big difference. Most of our people join us because they want to have an impact and they come from all different walks of life. We have bankers who are subject matter experts and were having very comfortable lives but they wanted to do something different and we enable that. We enable them to see the pain points in their jobs and see how we can tackle them through creating a venture that we think can have an impact. So that’s one example of people who join us but we have technologists, we have former entrepreneurs, successful functional people who are key to the success of SC Venture. So it’s the combination of all these talents that make us quite different.

And how will you measure your success?

We measure success first and foremost financially. So I hate it when people say you’re a strategic investor. Of course we’re a strategic investor, but that does not prevent us from looking at metrics such as MOIC and IRR. We need to have a positive impact and ultimately contributing to shareholder value of the group. So that’s what we’re set up to do.