Overview:

- Bridge Data Centres is one of the largest data center platforms in Asia Pacific, focusing on capital market strategy and regional expansion.

- The company operates over 400 megawatts of capacity with a pipeline exceeding 1.2 gigawatts, surpassing Singapore’s current capacity.

- Bridge differentiates itself through global reach, full-stack capabilities, and a proven track record in multiple markets.

- It is backed by Bain Capital with over $20 billion in data center investments, ensuring local relevance and global consistency.

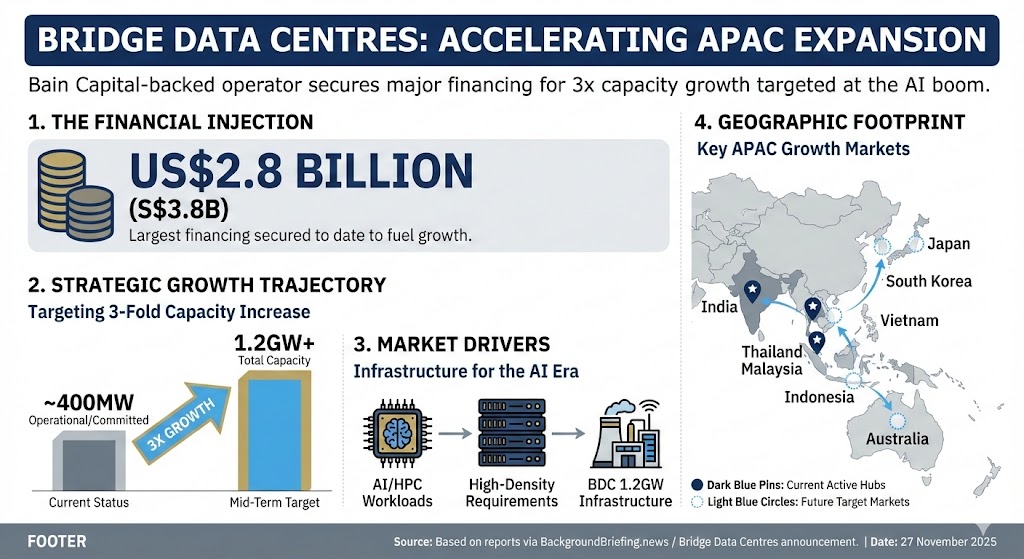

- A secured $2.8 billion financing package from 11 international banks enables rapid development and delivery for hyperscale clients.

Bridge Data Centres is accelerating its Asia Pacific footprint with a US$2.8 billion financing package and a pipeline exceeding 1.2 gigawatts, signaling a major push beyond Southeast Asia.

Rapid Growth and Scale

The company currently operates more than 400 megawatts of capacity, with plans to add over 1.2 gigawatts. “To put that in context, the entire country of Singapore has only about 900 megawatts in operations,” Kevin Guan, Chief Investment Officer at Bridge Data Centres, told BackgroundBriefing.news.

Why Scale Matters in the AI Era

Guan emphasized that hyperscale clients such as Google, Microsoft, and Amazon demand “scale, speed and most importantly certainty.” Bridge’s full-stack approach—from land acquisition to design and operations—enables faster delivery and consistent performance.

Global Backing and Financial Strength

Bridge is backed by Bain Capital, part of a global data center investment portfolio worth over US$20 billion. Guan noted, “Having secured a US$2.8 billion financing package from 11 international banks gives us the ability to build as the workers come in rather than try to win a contract and then raise money.” he told BackgroundBriefing.news.

First-Mover Advantage

The company claims leadership in Malaysia and Thailand, leveraging local relevance and global consistency to differentiate itself in a competitive market.

More stories: Standard Chartered fast-tracks cross-border banking to avoid delays in businesses’ global expansion

About the speaker:

Kevin Guan

Chief Investment Officer

Bridge Data Centres

Kevin Guan, Chief Investment Officer at Bridge Data Centres, leads initiatives in new business expansion, strategic development, capital markets, and cross-platform collaboration. His role focuses on driving growth and fostering partnerships across diverse markets.

With over a decade of experience in private equity and investment banking, Kevin has held senior positions at Bain Capital, Silver Lake Partners, and Morgan Stanley. He brings deep expertise in finance, strategic management, and entrepreneurship, supported by an MBA from The Wharton School and a BA in Economics from the University of California, Berkeley. His career spans Hong Kong, Boston, and Los Angeles, reflecting a global perspective.

FAQs:

What is Bridge Data Centres’ current operational capacity?

Bridge Data Centres operates more than 400 megawatts of capacity across Asia Pacific.What is the size of Bridge’s future pipeline?

The company has a pipeline exceeding 1.2 gigawatts, which is larger than Singapore’s entire current capacity.What role does Kevin Guan hold at Bridge Data Centres?

Kevin Guan is the Chief Investment Officer, focusing on capital market strategy and regional expansion.Why is scale important for Bridge Data Centres?

Hyperscale clients like Google and Microsoft demand scale, speed, and certainty for their operations.What differentiates Bridge from other data center companies?

Bridge offers global reach, full-stack capabilities from land acquisition to operations, and proven execution speed.Who backs Bridge Data Centres financially?

Bridge is backed by Bain Capital, which manages over $20 billion in global data center investments.How does Bridge ensure rapid development?

Bridge secured a $2.8 billion financing package from 11 international banks, enabling immediate construction.Which markets has Bridge pioneered in?

Bridge is a first mover in Malaysia and Thailand, establishing strong local relevance and global consistency.What is Bridge’s approach to design and operations?

Bridge handles design and operations in-house, allowing faster delivery and consistent quality.Who are Bridge’s main customers?

Bridge serves hyperscale clients including Google, Microsoft, Amazon, Tencent, Alibaba, and ByteDance.5W1H summary:

| Category | Summary |

|---|---|

| What |

1. Bridge expanding APAC data center footprint 2. $2.8B financing secured for growth 3. Pipeline exceeds 1.2GW capacity |

| How |

1. Full-stack design and operations approach 2. Backed by Bain Capital global investments 3. Financing from 11 international banks |

| Why |

1. Hyperscale clients demand scale and certainty 2. AI-driven data needs accelerating growth 3. Competitive advantage through speed and consistency |

| Who |

1. Kevin Guan, Chief Investment Officer 2. Bridge Data Centres leadership team 3. Clients include Google, Microsoft, Amazon |

| Where |

1. Operations in Malaysia and Thailand 2. Expansion across ASEAN and APAC 3. Comparison with Singapore’s 900MW capacity |

| When |

1. Current capacity 400MW operational 2. Pipeline planned for near-term growth 3. Financing secured before expansion phase |

Transcript of the interview:

Bridge as you know is one of the largest data center platforms in Asia Pacific. As chief investment officer my role is focused on capital market strategy and helping us expand beyond our home markets in Southeast Asia to broader APAC and beyond.

In terms of Bridge we are very fast growing. Today we are more than 400 megawatts of capacity under operation and a pipeline of more than a 1.2 gigawatts.

To put that in context, the entire country of Singapore has only about 900 megawatts in operations. So already half the size of Singapore and our plant capacity is more than 150% that of the current capacity of Singapore.

Why is Bridge actually so big? What is it that you have that other data center companies don’t?

That’s a good question, Mark. In the age of AI, increasingly our offtakers, the hyperscale customers Google, Microsoft, Amazon, Tencent, Alibaba, Bite Dance, are looking more and more for scale, for speed and most importantly for certainty.

For Bridge, our key differentiators are we’re global. We have proven full stack capabilities and we have a significant track record operating the markets that we have.

In terms of global we are the first mover in Malaysia and Thailand. We have significant backing from Bank Capital and we’re part of Bank Capital’s global family of data center investments, more than 20 billion in gross asset value.

That gives us that local relevance and global consistency. When it comes to speed, having a full stack capability does help from securing the land to building the building.

We do the designs ourself, and then ultimately to operating the data centers end to end, which allows us to move quicker and allows us to deliver with more consistency.

Lastly, having more than 400 megawatts in operation we know what it takes to operate a data center of that scale. Having Bank Capital support and also having secured a $2.8 billion financing package from 11 international banks gives that ability to build as the workers come in rather than try to win a contract from a customer and then go raise the money on the back of that contract.