Overview:

- The interview highlights the challenge retirees in Malaysia face in safeguarding and allocating retirement funds amid widespread scams and limited low-risk options, and positions digital assets as a diversification avenue.

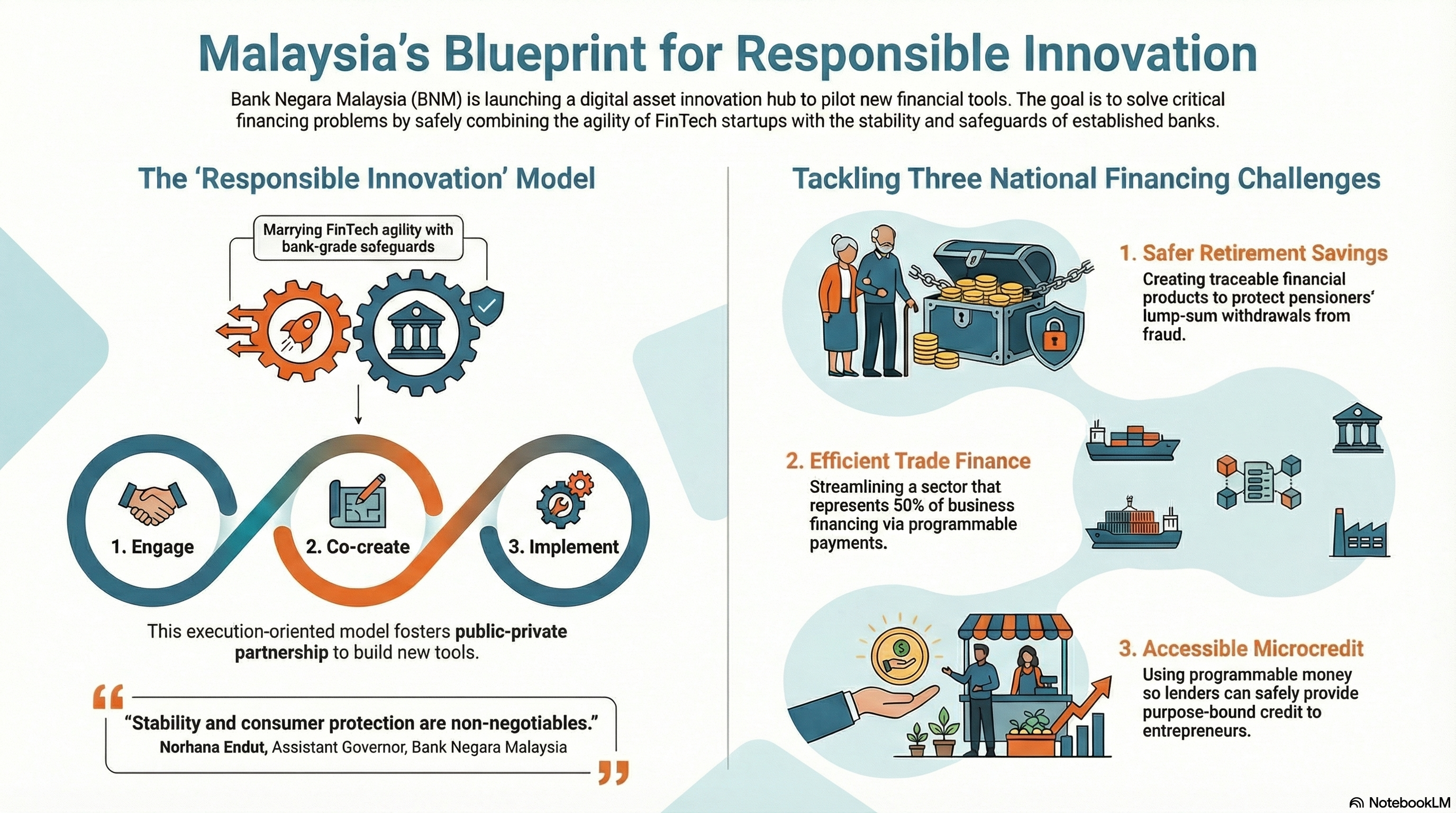

- The initiative is structured around a three‑fold strategy—engage the ecosystem players, co‑create with public and private partners, and implement.

- Bank Negara’s unique role is to deliver monetary and financial stability for digital assets by fostering responsible innovation and pairing agile fintechs with well‑regulated, well‑capitalized financial institutions.

- A core outcome is unlocking national savings—such as EPF balances as retirees draw down—through innovative instruments like retail bonds enabled by digital asset infrastructure.

- Additional targeted outcomes include boosting trade financing (around half of business financing) and expanding microfinancing, using blockchain programmability to trace funds and reduce lender risk for thin‑file entrepreneurs.

Bank Negara Malaysia (BNM) is establishing a digital asset innovation hub to tackle three financing pain points—how retirees deploy lump‑sum withdrawals safely, how companies unlock trade finance more efficiently, and how micro‑entrepreneurs access purpose‑bound credit—through a co‑creation model that marries fintech agility with bank‑grade safeguards. The initiative is framed as “responsible innovation” and aims to pilot programmable finance tools that reduce misuse and improve transparency for lenders and consumers.

Three‑fold blueprint: engage, co‑create, implement

BNM’s operating model for the digital asset innovation hub is deliberately simple and execution‑oriented. “We employ a three‑fold strategy: engage the ecosystem players, co‑create with public and private partners, and implement,” Dr Norhana Endut, Assistant Governor, Bank Negara Malaysia, told BackgroundBriefing.news. The bank’s role is to convene highly innovative startup teams with well‑regulated financial institutions that have funding capacity and established risk controls. “You are marrying two parts: a highly innovative, pushing‑the‑boundaries company with a big financial institution which has the funding power but is well regulated,” she said, adding that stability and consumer protection are non‑negotiables.

Unlocking retirement savings: retail bonds and safer allocation

The digital asset innovation hub is being positioned to create safer, diversified options for pensioners who face a limited menu of low‑risk products and rising fraud risks. The interviewee highlighted the scale of the savings challenge, noting the national retirement pool and proposing retail bonds and other innovative instruments as alternatives to fixed deposits or equity markets that demand daily monitoring. The objective is to use technology to embed traceability and guardrails that make it harder for scams to siphon funds and easier for retirees to allocate capital prudently.

Trade financing: addressing a 50% share of business funding

Trade financing represents about 50% of overall business financing making it a high‑impact target for digital upgrades. By testing programmable payments, document automation and purpose‑bound disbursements inside the digital asset innovation hub, BNM expects faster settlement, clearer audit trails and reduced leakage in supply chains. The goal is to unlock more trade activity by lowering operational friction for exporters and lenders while keeping supervisory standards intact.

Microcredit: programmable money to reduce misuse

Thin‑file micro‑entrepreneurs are often turned down by traditional banks due to limited documentation. The hub aims to pilot programmable money so lenders can bind disbursements to approved purposes and monitor flows. “With digital assets, with the blockchain technology, it allows programmable solutions… [funders] are able to actually track the money that they lend,” she mentioned. This traceability is intended to improve lender confidence, widen access to micro financing and reduce diversion risk.

Stability first: central bank oversight

BNM emphasises that the digital asset innovation hub will operate under central bank oversight to preserve monetary and financial stability. “This is a new area and one of the main concerns is the stability of the digital assets. That’s where the central bank comes in,” Dr Endut said. By pairing startups with regulated institutions and sequencing pilots through the engage‑co‑create‑implement path, the bank expects to surface viable models while containing risk.

More stories: Sapura Industrial marks 40th anniversary by expanding into EV and ESS battery business for Asian OEMs

FAQs:

What problem is the digital asset initiative aiming to solve for retirees?

It aims to give retirees safer, traceable ways to allocate lump‑sum withdrawals beyond fixed deposits, recognising that many do not want to monitor stock prices daily and that scams targeting retirement funds have proliferated; programmable, purpose‑bound instruments are intended to diversify returns while reducing misuse.

How will the digital asset innovation hub operate?

The hub follows a three‑fold approach—engage relevant players, co‑create solutions with public and private stakeholders, and implement pilots—so new products can be tested and refined in a controlled, central‑bank‑supervised environment before wider rollout.

What does “engage, co‑create, and implement” mean in practice?

“Engage” brings fintechs, banks and policymakers into the same workflow; “co‑create” pairs agile startups with well‑regulated financial institutions to design viable products; “implement” moves those designs into pilots and real transactions with the appropriate safeguards and monitoring.

What is Bank Negara Malaysia’s unique role in this programme?

The central bank ensures monetary and financial stability and convenes critical players, marrying boundary‑pushing fintechs with regulated institutions that have funding capacity and compliance frameworks; the guiding principle is “responsible innovation” because the solutions involve the public’s money.

How does the hub plan to unlock national savings like EPF withdrawals?

By using innovative solutions—such as retail bonds and programmable savings products—the hub seeks to create diversified, lower‑friction options for retirees to place funds, embedding traceability to deter fraud and making allocation decisions simpler than equities that require active monitoring.

Why is trade financing a priority, and what will change?

Trade financing accounts for roughly 50% of overall business financing, so digitising it can deliver outsized impact; the hub will explore programmable payments, document automation and trackable disbursements to speed settlement, cut leakage, and unlock more trade activity for exporters and lenders.

How will micro‑entrepreneurs benefit from programmable money?

Many thin‑file clients lack documentation and are turned down by banks; with blockchain‑enabled programmability, lenders can bind funds to approved uses and track flows, improving confidence, widening access to micro financing, and reducing diversion risk without relying solely on traditional bank accounts.

What safeguards will protect consumers and the financial system?

Central bank oversight, regulated‑institution participation, and purpose‑bound disbursement design create guardrails; pilots are run in a controlled environment to validate stability, data integrity and consumer protection before scaling any product.

Who can participate, and how are partnerships structured?

The hub invites ecosystem players—fintechs, financial institutions, and public sector entities—to collaborate; small innovators are paired with established, well‑capitalised banks to combine technology with robust risk management, ensuring solutions are practical and compliant from the outset.

5W1H summary:

| Label | Summary |

|---|---|

| What |

|

| How |

|

| Why |

|

| Who |

|

| Where |

|

| When |

|

About the speaker:

Dr Norhana Endut

Assistant Governor

Bank Negara Malaysia

Norhana Endut, Assistant Governor, Bank Negara Malaysia, has served since June 2020 in Kuala Lumpur. A career economist, she is recognized for expertise in econometrics, Stata, and analysis. Her publication record includes “The Changing Transmission of US monetary policy”. Endut earned a PhD in Economics from Washington University in St. Louis (1999–2005) and a Bachelor of Science in Economics from the University of Warwick (1991–1994), and attended Harvard Business School in 2019. Her experience reflects rigorous academic training and senior central banking leadership at Malaysia’s monetary authority.

Transcript of the interview:

Imagine if you’re already retired and you have this fund that you’re going to get from your retirement fund. What would you do with the fund? Chances are you’re going to go say travel or do that renovation that you’ve been wanting to do. But at the same time, you still will have some more money that you don’t know where to put.

And you hear right in Malaysia, there’s a lot of people that lost their money at the retirement age. That’s because there’s a profilation of scams and frauds in the country.

This is really discomfort to us and one of the thing that we thought about was how do we deal with this? People have the option to go to place their money in fixed deposits for instance but that’s about it.

At that age you probably do not want to go to the stock market to be at the need to monitor your shares prices on a daily basis. So this is not something what you want to do.

What digital assets is offering is actually to open up innovative solutions products that can allow people like pensioners maybe you in the next seven years to actually diversify your portfolios to diversify your retirement fund in terms of return. This is what we’re focusing on leveraging on technology to ensure that we solve real world economic problems and this is just one economic problem that we’ve been talking about.

And so how are you now bringing this digital platform?

Yes. So how do we do that? We have a three-fold approach to this. When we announced the digital asset innovation hub, we employ a three-fold strategy:

- To engage, and engage who, these are the players.

- To co-create with players either their private sector or the public sector.

- To implement.

So it’s engage, co-create, and implement. If you think about ICE, the IATU or I’m not sure whether you know the Malay word, this is the other way around just to remember. The opposite of ICE is engage, and C is co-create, and I is implement.

And what exactly is Bank Negara bringing to this table because there are so many players out there who are into digital assets? What’s your unique selling proposition in this?

This is a new area and one of the main concerns is the stability of the digital assets. That’s where the central bank comes in.

The central bank is mandated to ensure there is monetary and financial stability. So that’s where we come in.

What’s important is really to bring together critical players into the system. We know that the fintech companies are startups of young, highly tech technology companies.

They are at the forefront of this technology and we know they can drive them, but at the same time they may lack the experience and also the important safeguards to ensure stability because you’re talking about public’s money. That’s why we want to co-create.

When we say co-create, we want the small players, the fintech companies, to be co-creating with the big ones like the financial institution. They’ve been in the financial sector for a while and they are well regulated.

So you are marrying two parts: one, a highly innovative, pushing the boundaries companies, with a big financial institution player which has the funding power but is well regulated. That’s why we call co-create and the central bank comes in to ensure that this is within a more stable environment.

That’s why the word we use is responsible innovation, so innovation done responsibly.

And what’s the big plan? What’s the goal or the outcomes that you’re driving to?

The ultimate outcome is really to solve, to provide solutions to real world economic challenges or economic issues and I can talk about three things.

- We’re talking about unlocking savings, and I’ve just mentioned about the pensioner. We’re thinking about using innovative solutions to offer for instance the retail bonds, because innovative solutions allows us to do that.

- We will actually help with financing. Right now trade financing is one of the use cases that we’re looking at in the digital asset hub. Trade financing is made up about 50% of overall business financing. That’s a lot of trade activities that can be unlocked using innovative solution within the digital SRM.

- Solving issues with micro financing for instance. Micro financing clients have no documents and normally they get turned down by the typical financial institution.

With digital assets, with the blockchain technology, it allows programmable solutions. Financial funders do not need to worry about someone’s bank’s account but they’re able to actually track the money that they lend to.

These are three big major impacts that could affect coming from the outcome of the digital asset innovation hub. In short, we’re making an impact in terms of unlocking savings, promoting financing (business financing, trade financing and trade activities) as well as promoting financing with the micro entrepreneurs.