Overview:

- Roger Charles leads sustainability initiatives in corporate coverage at Standard Chartered Bank, focusing on client engagement and internal collaboration rather than strategy setting.

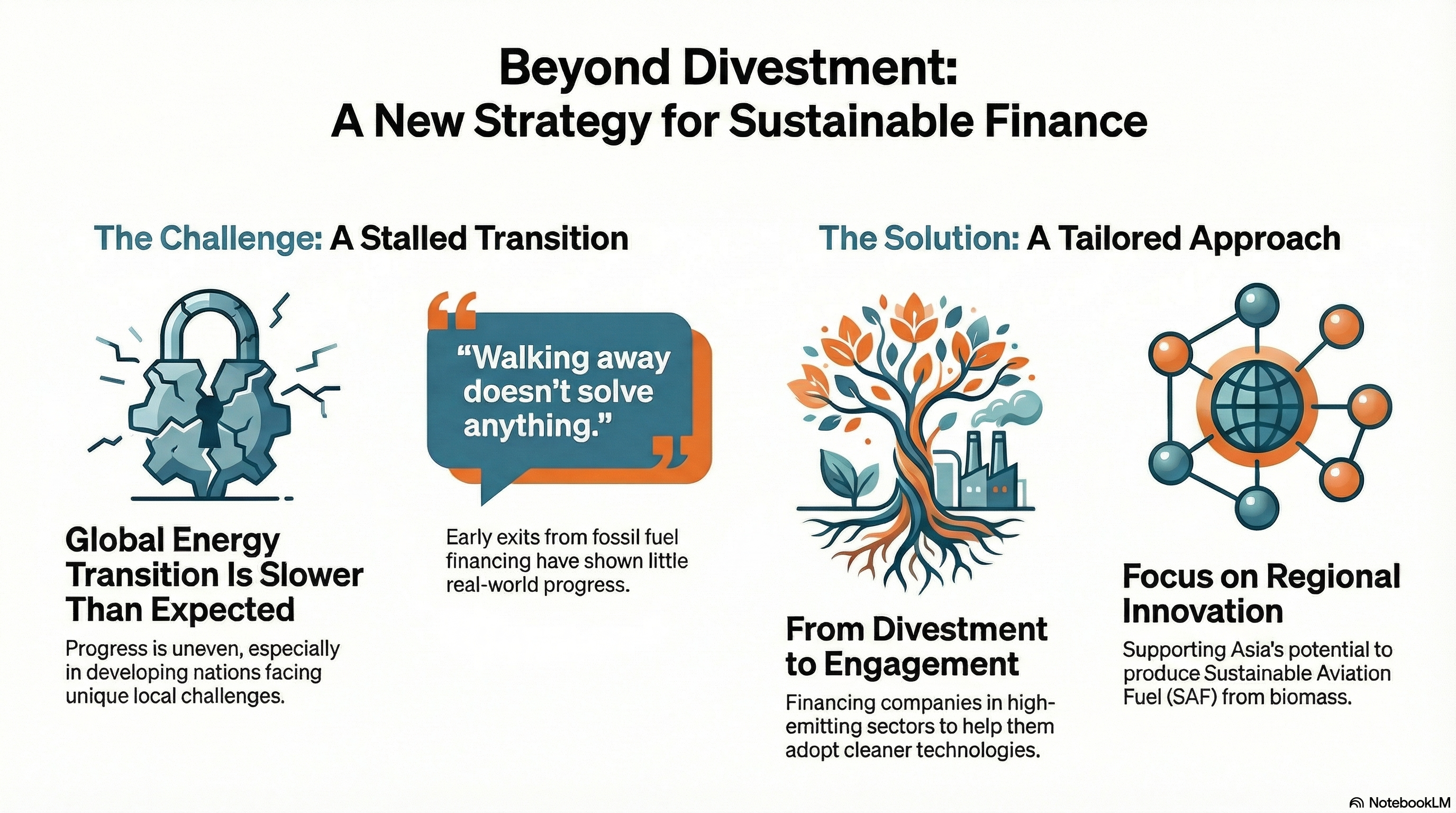

- They believe the global energy transition has stalled, especially in developing markets, due to slow policy development and differing socioeconomic dynamics.

- Standard Chartered adopts a tailored, market-specific approach to support developing nations in their unique paths toward decarbonization, rather than applying developed-world standards.

- The bank emphasizes transitioning high-emitting sectors by supporting innovation and cleaner alternatives, rather than divesting from them entirely.

- The ultimate goal is to prevent stranded assets by helping clients pivot toward sustainable products, leveraging regional strengths like Asia’s biomass for global decarbonization.

Standard Chartered Bank is reshaping its approach to sustainability in developing markets, acknowledging that the global energy transition has not progressed as expected. Roger Charles, Head of Sustainability Initiatives in Corporate Coverage, says the bank is moving away from a one-size-fits-all model and instead tailoring its support to the specific needs and realities of emerging economies.

Five years ago, optimism ran high around climate goals. But today, Charles says progress has been uneven. “The energy transition has been stalled. It hasn’t gone as quickly as we thought,” he told BackgroundBriefing.news. In developing countries, rapid population growth, industrialization, and policy delays have slowed momentum. These markets cannot be judged by the same standards as developed nations, he argues.

Tailored Financing for Transition

Standard Chartered is focusing on financing “the good stuff,” as Charles puts it—supporting companies in high-emitting sectors to pivot toward cleaner technologies rather than abandoning them. In Asia, where over 80% of power still comes from coal, the bank is helping energy and mining firms transition to cleaner fuels and critical minerals used in batteries and power infrastructure.

“Walking away doesn’t solve anything,” Charles mentioned. He points out that early exits from coal financing by banks have yielded little progress. Instead, Standard Chartered is engaging with regulators, international agencies like the IEA, and local banks to influence policy and drive change.

Supporting Regional Innovation

The bank sees opportunity in Asia’s abundant biomass resources to produce sustainable aviation fuel (SAF). Countries like Singapore and Indonesia have set SAF targets—1% today, rising to 5% by 2030. Standard Chartered aims to help these markets become global contributors to decarbonization, especially in hard-to-abate sectors like aviation.

The end goal is to prevent stranded assets and outdated technologies by guiding clients toward innovation. The bank’s regional approach, combined with its international reach, positions it as a thought leader in sustainable finance for emerging markets.

More stories: Global wealth shake-up: Advisers trapped by lag-time as crypto demand soars

About the speaker:

Roger Charles

Head of Sustainability Initiatives, Corporate Coverage

Standard Chartered

Roger Charles, Head of Sustainability Initiatives, Corporate Coverage at Standard Chartered Singapore, is a seasoned executive with over two decades of experience spanning banking, energy, and environmental consulting. He currently leads sustainability efforts within corporate coverage, driving ESG integration and risk management strategies across client portfolios.

Charles has held senior roles at DBS Bank, DuPont Sustainable Solutions, and Tullow Oil, where he specialized in environmental and social risk management, emergency response planning, and operational safety. His expertise covers sectors such as renewable energy, oil and gas, mining, and agroforestry. A graduate of the University of Greenwich in Environmental Sciences, Charles is recognized for his leadership in sustainability, regulatory compliance, and cultural transformation initiatives across Asia, Africa, and Europe.

FAQs:

What is Roger Charles’s role at Standard Chartered Bank?

Roger Charles is the Head of Sustainability Initiatives in Corporate Coverage, focusing on client engagement and helping bankers understand sustainable financing.Why does Standard Chartered take a different approach to developing countries?

The bank tailors its sustainability strategy to each developing market’s unique challenges, such as industrialization, population growth, and slower policy development.What is Standard Chartered’s position on coal financing?

While the bank avoids supporting coal expansion, it works with coal-related companies to help them transition to cleaner energy and critical minerals.How is Standard Chartered supporting the energy transition in Asia?

The bank is helping power and mining companies shift toward cleaner fuels and supporting the development of sustainable aviation fuel using regional biomass.What makes Standard Chartered’s sustainability approach unique?

Unlike many global banks, Standard Chartered applies a regional lens and avoids comparing developing nations to developed ones, focusing instead on local pathways to net zero.What is the bank’s long-term sustainability goal?

The goal is to prevent stranded assets by guiding clients toward innovation and sustainable products that align with future low-carbon markets.How does Standard Chartered view policy development in emerging markets?

The bank sees policy development as a key barrier and actively engages with regulators and agencies to help shape effective sustainability frameworks.What role does biomass play in Standard Chartered’s strategy?

Biomass, especially agricultural waste in Asia, is seen as a key feedstock for producing sustainable aviation fuel to help decarbonize the aviation sector.Why is walking away from coal not a viable solution?

According to Roger Charles, walking away hasn’t achieved meaningful change; instead, engagement and transition support are more effective.How does Standard Chartered collaborate with global agencies?

The bank works with organizations like the IEA and local regulators to influence policy and promote sustainable development in emerging markets.5W1H summary:

| What |

1. Energy transition challenges

2. Financing sustainability 3. Supporting client innovation |

|---|---|

| How |

1. Tailored market approach

2. Regional policy engagement 3. Financing transition sectors |

| Why |

1. Climate risk is real

2. Avoid stranded assets 3. Support net zero goals |

| Who |

1. Roger Charles

2. Standard Chartered Bank 3. Corporate clients |

| Where |

1. Singapore

2. Malaysia 3. ASEAN region |

| When |

1. Past 5 years

2. By 2030 SAF target 3. Current transition phase |

Transcript of the interview:

I am the newly appointed head of sustainability initiatives in corporate coverage in Standard Chartered Bank. My role predominantly involves everything sustainability but from the business side of the bank. I am not there to set strategy. I am there to work with our clients to bring them across the line. I am there to help our bankers understand the industries and how we can finance the good stuff these days as opposed to the convent financing that we’ve done in the past. How do we move the needle to address climate change and how do we bring elements of the bank together to work as one? Really about joining the dots.

Where do you see the energy transition heading?

The energy transition has been stalled. It hasn’t gone as quickly as we thought. 5 years ago, we all were very optimistic that we were going to achieve certain targets and certain goals. Globally in some of the developing countries that we operate in we have achieved this already. In some of the developing markets though it has been much slower and that’s been for a number of reasons such as policy. Policy development hasn’t happened quick enough. In the developing market it does assume that they are developing and they’re getting bigger. Population growth, GDP growth, the working class moving to the middle class and middle class moving into the upper class mean more cars on the road, more money. This market in itself means how do we — you can’t apply that same lens that you look at a developed country to a developing country. They’re industrializing. They have more mouths to feed. They have bigger populations and growing populations. How do you apply lens to such a nation or a market where there’s so much opportunity to do good here but not be constraining?

What’s Standard Chartered doing to further this growth?

In terms of how do we look at these developing nations we look at them as an individual market. We look at it from different aspects from policy to population growth to industrialization. Where are they moving into? What are they doing? What are the opportunities into the future and looking at their pathway and looking how they’re developing, we take a slightly different approach. We break away from what we consider this more cumbersome approach of comparing developed nations to developing nations and we take a more focused approach. We say, the developed nations, well done. You’ve done really well. But for the developing nations, we can’t use the same yard stick anymore. We have to be able to support them and acknowledge that. For example, in Asia today, over 80% of our power still comes from coal. How do we bring down coal over a period of time? It wasn’t what we thought 5 10 years ago that you could just shut down coal fired power stations. That’s not going to happen. It was unrealistic for us to think that. Therefore, the coal is there. We don’t want to support the coal, but we can support the same companies, the power companies, the mining companies to transition into either cleaner fuels or even on the mining side. How they’re transitioning into mining transition commodities that go into critical minerals, that go into batteries, that go into power lines. This is where we want to see it go. Walking away doesn’t solve anything. 5 years ago when all the banks started to walk away from coal at the beginning of this decade, what has it actually achieved? It hasn’t achieved anything. What is Standard Chartered bringing to this conversation that other banks don’t? We’re taking. We’re bringing in a regional approach for an international bank to take this regional approach and also be an influencer at this level. We see local banks. We want to be a thought leader in this space. We want to work with international agencies like the IEA to really push hard. We want to work with regulators. We have a seat at the table but it’s the conversation that we’re bringing to the table to say we want to do more but we have to also understand some of the issues that are stopping us doing more and how do we solve for these. When we talk about this global approach of comparing apples to apples it’s not because you’re comparing apples to bananas for example. Therefore, we need to take more of an approach of where we can look at a nation or a market as its own individual market and their own pathway to get to net zero. We want to support them on that path.

What’s the end game? What are the outcomes that you’re driving to with this?

It’s a double. Climate change is real. It’s a risk. Where you see corporate clients who are operating in a high emitting sector where they’re in a growth market as well. Then where we see is that these industries would become in the future what we call stranded assets or stranded companies because their technology is outdated and everything else. What we’re trying to do is to work with these clients to acknowledge that there’s still a need for the products they’re producing but also to help direct them into new products and new innovation which to be fair they’re already doing. Where we look at these markets. You take certain markets in Asia. If we’re going to produce more biofuels or sustainable aviation fuel. It’s underpinned by this policy. Singapore, Indonesia, all of these countries have set SAF or sustainable aviation fuel usage. It’s incremental. It’s 1% today. It will be 5% by 2030. Where’s all that going to come from? It comes from agricultural feed stock waste. Where do we have all of this bountiful supply of biomass in the world? It’s in Asia today. How do we harness that? How do we use that? How do we create these developing markets that have historically been very high emitting, but how do we pivot them to help the rest of the world to decarbonize, especially for an industry such as aviation?